A. introduction

A business opportunity is a basic concept that means getting a deal at an attractive price relatively to market prices. On the part of the buyers, business opportunities will be expressed as low purchase prices and from the seller's perspective relatively high prices. The question arises how to locate a business opportunity. The answer to this is “sources of information” which sellers or buyers need to get.

In this article, we will mainly discuss how to use data analysis so that we can understand how opportunities are located. This article does not deal with opportunities that are based on business obligations or difficulties.

B. Reverse point

Most of the buyers or sellers use sources of information in connection with expected trends. For example, if sellers know that prices are likely to fall, they will prefer to sell until the point of reversal and before prices reach to their lowest levels. In the same way, buyers who know that the prices will rise, they will prefer to buy until reaching to the reversal points, before prices reach to their highest levels) and instead of paying higher prices in the future.

C. What information is relevant and how it has been tested

Information is divided into several types. Preliminary information is taken directly from the market by means of self-surveys and by interviewing market participants, whether buyers or sellers.

Secondary information is information collected from kinds of general and public sources, whether from governmental-institutional services and/or from stock exchange markets, bonds, securities, etc.

Initial sources of information can be found within the markets. All that is left to do is to analyse the information and draw relevant conclusions.

For example, a large business that analyse its own demand and supply of its products and services can foresee trends and if it is large enough, to infer market trends.

Smaller businesses assuming that they lack preliminary information (not necessarily), may need to analyse secondary sources of information regarding expected trends. Secondary sources of information are published through public service bureaus such as the Central Bureau of Statistics, government ministries, parliament publishes, the Bank of Israel, chambers of commerce, the stock exchange and private entities. The disadvantage of these sources, which are submitted to the public, may not be updated and therefore may bias the credibility of the forecasting of trends.

Data Review Period – In order for data to be validated, the data type must be examined. For example, if a market changes frequently due to government decrees or benefits, it is necessary to analyse short periods in which the changes were created and compare them to other periods of similar changes, in addition to analysis of long terms series. Let's say, for example, in a case of imposing taxes on the housing market, we will need to examine the effects of tax on demand and supply in defined periods and in addition to long-term series that will describe overall price trends.

Data collection is usually the work of economic or business consultants who review the market and specialize in it, like analysts who review companies and trends of their stock prices in the coming periods.

D. How to identify a business opportunity

We distinguish between purchaser and seller. Sellers wish to maximize profits or reduce losses, while buyers wish to buy cheap and maximize their profits in the future. Both buyers and sellers try to find reversal points and trends and to make a deal up to it. At the turning point, the economic viability between buying and selling changes. The work of the economic-business consultant is to analyse the market in such a way as to identify reversal points as precisely as possible.

Economic and business consultants are required to have a deep strategic understanding, data analysis capability and comprehensive systemic vision of large players and their degree of influence. Mathematical or statistical equations are essential but they are not enough for this purpose. Analysis which is based on healthy senses stemming from the experience of the consultants, can do well and enhance the validity of conclusions.

E. The reversal point, the reaction agility, and the business opportunity

If a business opportunity is identified but not utilized during the response period defined as the reaction time, it is insignificant. Market forces generally take care to eliminate a business opportunity over time so that it can be lost at the next reversal point. Response period for sale and buyback time are the periods for exploiting or realizing a business opportunity.

To illustrate this, we will take a business in the field of consumption of cheap domestic products. let's say that the business is for sale. (The balance sheets of the business are important in determining the value of assets, but the economic value is a function of analysing the trends and finding the reversal points).

If there is an upward trend and the market share of the business and / or its profitability increases, we will expect positive prices trends and a business opportunity for the seller to sell the business at a relatively high price (response period for sale). On the other hand, a buyer who sees a decrease in the business’s share and / or its profits, may take an advantage of this business opportunity (buyback time) and purchase at relatively cheap prices.

Therefore, if a correct analysis is prepared by buyers or sellers and in cases that they do not miss the reversal points, they may utilise business opportunities during these relevant periods.

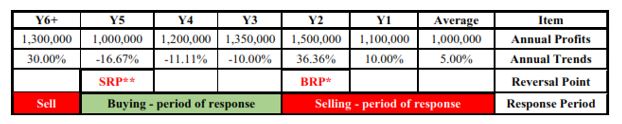

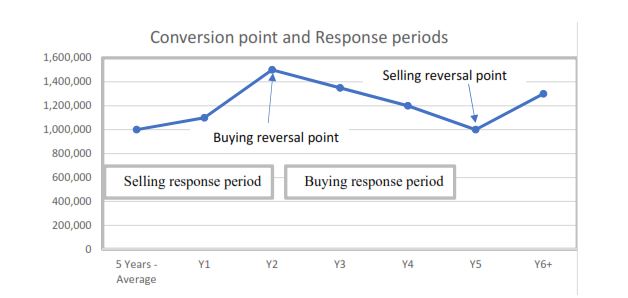

The following table and chart illustrate the reversal points and periods of response which underlie business opportunities which rely upon the “speed of response”.

* BRP – Buying Response Period

** SRP – Selling Response Period

F. explanation

As far as sellers are concerned, there is a business opportunity for sale by the end of the second year. In terms of buyers there is an opportunity to buy until the end of the fifth year. A reversal point from a selling position to a buy position is in the second year. A reversal point from a buying to a selling position is from the fifth year.

In the aforementioned response times or reversal points, there are business opportunities.

Business and economic consultants are aware to the reaction times and inversion points and can predict them with a high degree of certainty based on data collected, either primary and/or secondary.